Apple Reports Record-Setting 1Q 2026 Results: $42.1B Profit on $143.8B Revenue

Apple Shatters Records: A Deep Dive into a Monumental Quarter (Q1 2026)

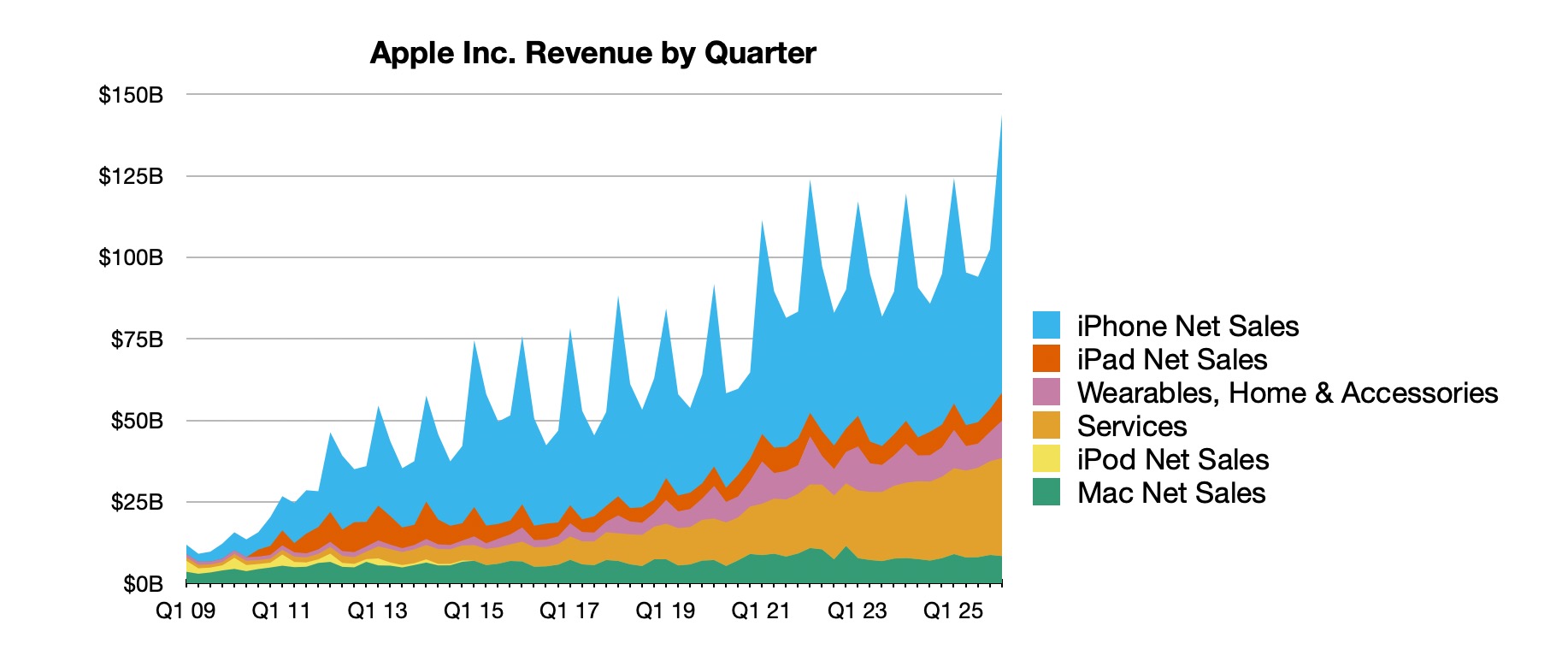

Apple has just announced its financial results for the first fiscal quarter of 2026, covering the calendar period of October to December 2025. This quarter has proven to be an extraordinary one, marked by unprecedented success across various segments of the company's vast empire.

The tech giant reported staggering figures, showcasing robust growth and an ever-strengthening market position. Let's delve into the details of what made this quarter truly historic for Apple.

A Quarter of Unprecedented Growth and Profitability

For the first fiscal quarter of 2026, Apple proudly declared a monumental revenue of $143.8 billion. This impressive figure translated into a net quarterly profit of $42.1 billion, resulting in earnings of $2.84 per diluted share. To put this into perspective, let's compare it to the same quarter a year ago (Q1 2025), where Apple reported revenue of $124.3 billion and a net quarterly profit of $36.3 billion, or $2.40 per diluted share. This represents a significant leap in performance, underscoring Apple's continued ability to innovate and capture market share.

The term "diluted share" refers to the earnings per share calculated assuming all convertible securities (like stock options or convertible bonds) are exercised or converted into common stock, which typically increases the number of shares and thus dilutes the earnings per share. In Apple's case, even with this dilution factored in, the earnings per share showed remarkable growth, indicating strong underlying profitability.

This quarter saw Apple establish new all-time records across several critical metrics. The company achieved its highest-ever total revenue, highest earnings per share, and record revenues specifically from its iPhone and Services categories. Overall, total revenue surged by an impressive 16 percent compared to the previous year, while earnings per share climbed by an even more remarkable 19 percent. These numbers reflect strong consumer demand and effective operational management.

The company's financial health was further highlighted by its gross margin, which stood at 48.2 percent for the quarter. This is an improvement from the 46.9 percent reported in the year-ago quarter, indicating better cost control and potentially higher pricing power for its products and services. Gross margin is the percentage of revenue left after subtracting the cost of goods sold, and a higher percentage typically signifies greater efficiency and profitability.

In a gesture of confidence and commitment to its shareholders, Apple also announced a quarterly dividend payment of $0.26 per share. This payment is scheduled for February 12, reaching all shareholders officially recorded as of February 9. Dividends are a portion of a company's earnings paid to its shareholders, reflecting its financial stability and success.

Tim Cook's Vision: "A Remarkable, Record-Breaking Quarter"

Tim Cook, Apple's CEO, expressed immense pride and satisfaction with the company's performance, stating:

"Today, Apple is proud to report a remarkable, record-breaking quarter, with revenue of $143.8 billion, up 16 percent from a year ago and well above our expectations. iPhone had its best-ever quarter driven by unprecedented demand, with all-time records across every geographic segment, and Services also achieved an all-time revenue record, up 14 percent from a year ago. We are also excited to announce that our installed base now has more than 2.5 billion active devices, which is a testament to incredible customer satisfaction for the very best products and services in the world."

Cook's statement underscores several key takeaways. The "unprecedented demand" for iPhone suggests that the latest models resonated exceptionally well with consumers globally, leading to record sales in every region. The robust growth in Services revenue further solidifies Apple's strategy of expanding its ecosystem beyond hardware. Perhaps most significantly, the milestone of "more than 2.5 billion active devices" highlights the immense loyalty and satisfaction of Apple's global customer base. An "installed base" refers to the total number of devices currently in use by customers, and this growing number provides a strong foundation for future revenue streams through both hardware upgrades and increasing engagement with services.

Looking Ahead: Apple's Projections for the March Quarter

Apple's confidence extends into the current quarter. For the period ending in March, the company is forecasting continued strong performance, projecting year-over-year revenue growth of between 13% and 16%. Furthermore, Apple anticipates its gross margin to remain healthy, falling within the range of 48% to 49%. These projections indicate a sustained positive outlook for the company's immediate future, suggesting that the momentum from the record-breaking December quarter is expected to carry forward.

Conference Call Highlights: Diving Deeper into the Numbers

Following the initial announcement, Apple provided a live stream of its fiscal Q1 2026 financial results conference call, offering further insights into the company's performance and strategic direction. Kevan Parekh, Apple's CFO, kicked off the detailed financial recap, emphasizing the record-setting nature of the quarter.

CFO Kevan Parekh on Record-Breaking Performance

"During the December quarter, our record business performance and strong margins led to EPS growth of 19 percent, setting a new all-time EPS record," said Kevan Parekh. "These exceptionally strong results generated nearly $54 billion in operating cash flow, allowing us to return almost $32 billion to shareholders." Operating cash flow refers to the money a company generates from its regular business activities, before accounting for non-cash expenses or investment activities. A high operating cash flow indicates a company's ability to fund its operations and investments from its own earnings, without needing external financing.

The market reacted positively to these impressive figures, with Apple's stock price climbing by almost 2% in after-hours trading immediately following the earnings release. This positive market response reflects investor confidence in Apple's financial health and future prospects.

Product Performance Breakdown

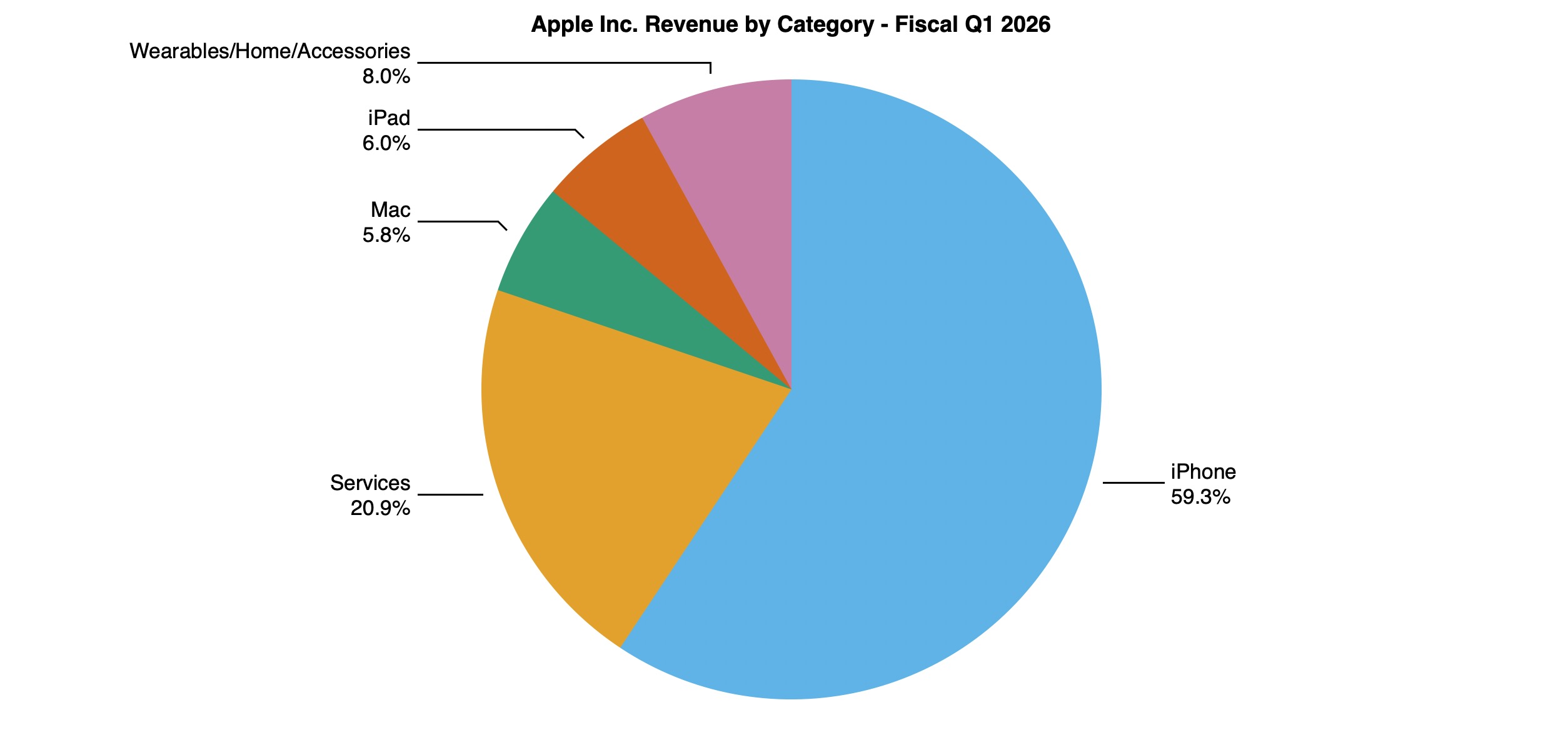

A closer look at revenue by product category revealed a mixed but generally strong picture:

- iPhone: Revenue soared by an astounding 23.3% year-over-year, showcasing the immense popularity of the latest iPhone lineup. This significant growth was a primary driver of Apple's overall record revenue.

- Services: Continuing its impressive trajectory, Services revenue increased by a healthy 13.9%. This category includes subscriptions like Apple Music, Apple TV+, iCloud, and revenue from the App Store, proving its crucial role in Apple's ecosystem.

- iPad: The tablet segment experienced a modest but positive growth of 6.3%.

- Mac: Mac revenue saw a decline of 6.7%. This downturn was anticipated, partly due to tough comparisons with previous quarters that saw the launch of popular M4 MacBook Pro, Mac mini, and iMac models.

- Wearables, Home and Accessories: This category, which includes products like Apple Watch, AirPods, and AirTags, saw a slight decrease of 2.2%. Constraints in the supply of products like the AirPods Pro 3 were identified as a contributing factor to this dip.

Geographic Segment Performance

From a global perspective, Apple achieved growth in all its key geographic segments:

- Greater China: Witnessed an exceptional surge of 37.9%, demonstrating strong demand in one of Apple's most vital markets.

- Europe: Grew by 12.7%.

- The Americas: Increased by 11.2%.

- Rest of Asia Pacific: Saw an 18.0% rise.

- Japan: Posted a more modest but still positive growth of 4.7%.

Live Conference Call: Deeper Insights from Tim Cook and Kevan Parekh

The earnings call began promptly, with Apple CEO Tim Cook and CFO Kevan Parekh addressing analysts. Suhasani Chandramouli, Apple's director of investor relations, opened the call with the standard warnings regarding forward-looking statements, which are predictions about future business performance that carry inherent risks.

Tim Cook's Opening Remarks: Celebrating Success

Tim Cook reiterated his earlier excitement, stating, "I am proud to say that we just had a quarter for the record books." He emphasized the $143.8 billion in revenue, exceeding expectations and growing 16% year-over-year. The CEO highlighted the "simply staggering" demand for iPhone, which saw revenue jump 23% year-over-year and set all-time records across every geographic segment. Services also achieved a new revenue high, up 14%, contributing to the all-time record EPS of $2.84, a 19% increase from the prior year. Cook specifically noted record performances in the Americas, Europe, Japan, and the rest of Asia Pacific, with Greater China showing a remarkable 38% growth.

iPhone's Unstoppable Momentum

Cook described the December quarter as "fantastic for iPhone," with sales reaching $85.3 billion. This 23% year-over-year growth was attributed to "the strongest iPhone lineup we've ever had and by far the most popular." The current iPhone models, with their advanced features and design, clearly struck a chord with consumers worldwide.

Mac and iPad Performance

While Mac revenue was $8.4 billion, Cook noted that the Mac installed base reached another all-time high, with "nearly half" of new Mac purchasers being entirely new to the product. This indicates Apple's success in attracting new users to its computer ecosystem. Similarly, iPad revenue hit $8.6 billion, up 6% year-over-year, setting an all-time record for upgraders, meaning existing iPad users chose to buy a newer model.

Wearables, Home, and Accessories

This category generated $11.5 billion in revenue, encompassing popular devices like Apple Watch, AirPods, and AirTags. Cook acknowledged the strong appeal of these products.

The Power of the Installed Base and Customer Satisfaction

Cook proudly reported a new record for Apple's installed base, now exceeding 2.5 billion active devices. This enormous base signifies incredible customer satisfaction and provides a fertile ground for future sales and service growth. He noted that a majority of users on compatible iPhones are already actively utilizing Apple Intelligence, the company's suite of AI features, indicating rapid adoption.

The Dawn of Apple Intelligence

Cook elaborated on Apple's AI strategy, stating, "We are bringing intelligence to more of what people already love about our products, so we can make every experience even more capable and effortless." He also revealed an exciting collaboration with Google:

"We are also collaborating with Google to develop the next generation of Apple foundation models. These will help power future Apple Intelligence features including a more personalized Siri, coming this year." This partnership with Google aims to enhance Apple's AI capabilities, particularly for a more intuitive and personalized user experience with Siri, Apple's intelligent assistant.

Services Continue to Soar

The Services division delivered an all-time revenue record of $30 billion, marking a 14% increase from the prior year. This growth was seen in both developed and emerging markets. Cook highlighted significant growth in Apple TV viewership, which increased by 36% over the previous year, and announced exciting sports content, including exclusive US rights for every Formula One practice, qualifying, sprint, and Grand Prix, alongside all MLS regular and postseason games. Apple Music also reached new highs in listenership and new subscriber growth. The App Store continues to be a massive success, with developers earning over $550 billion on the platform since 2008.

Retail Expansion and Commitment to American Innovation

Apple also saw its best-ever results for retail, with the opening of a fifth store in India and another planned for Mumbai. Cook emphasized Apple's commitment to supporting American innovation, detailing investments of $600 billion over four years in vital industries like advanced manufacturing, silicon, engineering, and artificial intelligence. These investments, with partners like Corning in Kentucky and Micron, support nearly half a million jobs across all 50 states, contributing to the development of an end-to-end silicon supply chain within the US.

Tim Cook concluded his opening remarks with a confident assertion: "This was, in so many ways, a remarkable quarter for Apple... I have every confidence that our best work is yet to come."

CFO Kevan Parekh's Detailed Financial Overview

Kevan Parekh provided a more granular breakdown of the financial figures. He confirmed the company's gross margin at 48.2%, which was "above the high end of our guidance range." Product gross margin stood at 40.7%, improving by 450 basis points sequentially (a basis point is one-hundredth of a percentage point, so 4.5%). Services gross margin was an impressive 76.5%, up 120 basis points sequentially, reflecting the high profitability of digital services. Operating Expenses rose to $18.4 billion, a 19% year-over-year increase, primarily driven by increased investment in research and development (R&D). Net income reached $42.1 billion, and diluted earnings per share were $2.84. Operating cash flow hit another all-time record at $53.9 billion.

iPhone Dominance and Customer Loyalty

Parekh reiterated iPhone revenue at $85.3 billion, up 23% year-over-year, noting its strength globally with revenue records in the US, Greater China, Latin America, Western Europe, Middle East, Australia, and South Asia. The quarter also saw a new all-time record for upgraders across many countries. A survey from Worldpanel confirmed iPhone as a top-selling model in key markets, and customer satisfaction for the iPhone 17 family was measured at an exceptional 99% by 451 Research.

Mac and iPad Performance in Detail

Mac revenue was $8.4 billion, down 7% year-over-year. This was primarily due to tough comparisons against last year's launches of the M4 MacBook Pro, Mac mini, and iMac. However, Parekh highlighted that nearly half of Mac purchasers were new to the product, with customer satisfaction at 97%. iPad revenue, at $8.6 billion, was up 6%, with more than half of iPad customers new to the product and customer satisfaction at 98% in the US. The iPad installed base also reached a new all-time high, alongside a record for upgraders.

Wearables, Home and Accessories: Supply Constraints

This category reported $11.5 billion in revenue, down 2%. Parekh specifically mentioned that AirPods Pro 3 were supply-constrained, and without these limitations, the category would likely have shown growth. Apple Watch customer satisfaction was 96%, with over half of buyers being new to the product.

Services: A Foundation for Growth

Services revenue of $30 billion, up 14% year-over-year, saw all-time records in advertising, music, payment services, and cloud services. Double-digit growth in paid subscribers further fueled this segment. The massive 2.5 billion active devices installed base provides an "incredibly strong foundation for new growth opportunities."

Enterprise Momentum and Financial Health

Parekh noted growing enterprise adoption, citing Mac deployments at Snowflake, iPad Pros at AstraZeneca, and MacBook Airs at Coppel in Mexico. Financially, Apple maintained a strong position with $145 billion in cash and marketable securities, $91 billion in total debt (resulting in $54 billion net cash), and returned $32 billion to shareholders through dividends and $25 billion in share repurchases of 93 million Apple shares.

March Quarter Guidance Explained

For the upcoming March quarter, Apple expects total company revenue to grow between 13% and 16%. Services revenue is projected to grow at a similar year-over-year rate as in December. Gross margin is anticipated to be between 48% and 49%. Operating expenses are expected to be between $18.4 billion and $18.7 billion due to higher R&D costs. The tax rate is projected at around 17.5%, and the $0.26 per share dividend will be paid in mid-February.

Analyst Q&A Session: Addressing Key Concerns and Future Strategies

The Q&A session provided further clarity on Apple's performance and strategy, addressing concerns ranging from supply chain dynamics to AI monetization.

Understanding Memory Constraints and Gross Margins

An analyst inquired about the impact of memory on gross margins and Apple's ability to secure components. Apple explained that customer response to the latest iPhone was "thrilling," leading to a 23% growth in sales and "very lean channel inventory" by the end of December. The company is currently in a "supply chase mode" to meet the high demand, facing constraints primarily in the "advanced nodes" (the most cutting-edge manufacturing processes) where their System-on-Chips (SOCs) are produced. They noted "less flexibility in supply chain than normal" due to increased demand. While memory had a minimal impact on Q1 gross margin, a more significant impact is expected in Q2, factored into the 48-49% guidance. Apple acknowledged that market pricing for memory is increasing significantly and will explore various options to manage this.

The Power of China's Market

Asked about the extraordinary strength in China, Apple attributed the 38% growth in Greater China to the best iPhone quarter in history for the region. Store traffic saw strong double-digit growth, the installed base reached an all-time high, and records were set for upgraders. iPhones were among the top three smartphones in urban China, while Mac and iPad also saw significant success with new customers. iPad was the top tablet, MacBook Air the top-selling laptop, and Mac mini the top desktop model in urban China during the quarter. This strong performance was primarily driven by compelling product offerings and positive customer reception.

Monetizing AI: Value Creation Over Direct Revenue

Regarding revenue potential from AI and the Google partnership, Apple clarified its strategy. The company is focused on integrating "intelligence to more of what people love," enhancing user experiences in a personal and private way across its operating system. This approach aims to create significant value, which in turn "opens up a range of opportunities across our products and services." While direct monetization wasn't explicitly detailed, the focus is on strengthening the ecosystem and increasing user engagement, which indirectly drives sales and service subscriptions.

Key Drivers of iPhone's Success

When asked about the primary factors behind iPhone's exceptional strength and its sustainability, Apple emphasized that it's a "combination of things" that make the product compelling for different user "cohorts" (groups of users). This includes the advanced display, powerful camera systems, overall performance, new selfie camera, and beloved design. These combined elements create a "very strong product cycle," as evidenced by the December quarter results, and are expected to sustain demand.

March Quarter Outlook: No Significant "Comps" Issues

Addressing potential "comps" (comparisons to strong previous quarters that might make current growth look less impressive, like last year's M4 MacBook Air or iPad Air launches), Apple stated there were "no comp issue that we would note" that would significantly impact their outlook. They anticipate a "continue of the strong cycle," subject to the previously mentioned supply constraints.

Expanding Services and Advertising Opportunities

On the Services front, Apple confirmed strong performance in advertising, alongside music, payment, and cloud services. They highlighted new ad slots in the App Store and mentioned that they "continue to look for ways to expand opportunities to add value to users and to Apple." The vast installed base of 2.5 billion active devices provides exciting avenues for growth in the services business, including features like Wallet and digital ID.

Details of the Google AI Partnership

Apple explained that the decision to partner with Google for AI was based on Google's AI technology providing "the most capable foundation for Apple Foundation Models." The collaboration is expected to "unlock a lot of experiences and innovate in a key way." Apple emphasized its commitment to privacy, ensuring that AI processing will continue to run "on the device and run in private cloud compute" while maintaining "industry leading privacy standards." The financial details of the arrangement with Google were not disclosed.

Gross Margin Strength: Favorable Mix and Product Cycle

Analysts expressed surprise at Apple's ability to maintain high gross margins (48-49%) despite rising memory prices. Apple attributed its Q1 gross margin of 48.2% to a "favorable mix." A strong product cycle, especially for iPhone, leads to more favorable opportunities on the leverage side, where higher volumes can reduce the per-unit cost. Product gross margins improved sequentially by 450 basis points, and the double-digit growth in Services also contributed positively. This combination of favorable product mix and strong service growth helps offset rising component costs.

Smartphone Market Demand and Apple's Position

Regarding the overall smartphone market demand and potential impacts from rising memory prices or component availability, Apple noted that the supply constraints are specific to advanced node capacity, a direct result of the exceptional 23% growth in Q1 that "far outstripped what we had internally estimated." While they gained market share in the December quarter (as the market wasn't growing at 23%), Apple refrained from predicting future market reactions, acknowledging the difficulty in such forecasts. They confirmed having a "range of options" to address memory pricing, from long-term agreements (LTAs) to spot-based purchases.

App Store Growth: Broad-Based Performance

When questioned about third-party data showing a deceleration in App Store growth compared to Apple's reported 14% overall services growth, Apple confirmed a quarterly record for the App Store. However, they stated that they "don't provide specific color on how the individual services categories have done," emphasizing instead "broad-based growth across all the different categories" and records in both developed and emerging markets with double-digit growth.

Pricing Strategy and Memory Costs

An analyst asked if pricing would be a lever Apple would use to counteract rising memory costs, given their historical reluctance to adjust prices unless for significant foreign exchange market dislocations. Apple declined to speculate on this, indicating a preference for other methods of cost management.

Capital Investment and Cloud Strategy

Regarding capital investment (capex) and its potential relation to the Google partnership or Apple Private Cloud, Apple explained that its capex follows a "hybrid model" and can be "volatile independent of our business." It includes various items like tooling, facilities, retail investments, and data centers, leveraging both first- and third-party capacity. Therefore, drawing conclusions from capex fluctuations is difficult. They noted spending related to building out their private cloud compute environment in December, aligning with their strategy of both on-device and private cloud AI processing.

Product Gross Margin and Tariffs

On product gross margin, Apple highlighted a "higher favorability than you might have seen in other cycles," due to a "more favorable offset from the mix and leverage versus historical" because of strong demand for products like the iPhone 17. They also confirmed that tariffs amounted to approximately $1.4 billion for December, landing within their estimated range.

Apple Foundation Models vs. Third-Party Collaboration

Clarifying the distinction between Apple's own AI models and third-party collaborations, Apple described the Google partnership as a "collaboration" where they will also "independently do our own stuff." The personalized version of Siri is specifically envisioned as a product of this collaboration with Google.

Market Share Gains Amidst Constraints

Asked if memory constraints faced by competitors might allow Apple to increase its market share, Apple stated that based on current information, the iPhone gained share in the quarter, and Mac gained share for the full year. They expressed confidence in their competitive position without directly commenting on competitor challenges.

iPhone 17 Upgrade Cycle and Apple Intelligence

Comparing the iPhone 17 upgrade cycle to past successful periods, Apple emphasized that "each cycle has its own characteristics" and declined to compare it to a specific prior cycle. They highlighted the iPhone 17's unique blend of compelling features that have "really resonated with multiple cohorts" of customers, whether on older or newer devices. Apple Intelligence is expected to further enhance the refresh rate by making existing products even more capable and desirable.

Advanced Packaging Constraints and Supply-Demand Balance

Apple acknowledged being constrained on "advanced packaging," specifically "3nm" nodes where their latest SOCs are produced. This constraint is "gating the Q2 supply" and is a direct result of the "23% growth far outstripping what we had internally estimated." While internal estimates for demand exist, Apple finds it "difficult to estimate demand when you haven't met the demand" and cannot predict when supply and demand will balance.

Unpacking the Indian Market Growth

Beyond China, Apple highlighted significant success in India, which saw quarterly revenue records for iPhone, Mac, and iPad, along with an all-time revenue record for Services in the December quarter. Apple views India as a "huge opportunity," being the second-largest smartphone market and fourth-largest PC market globally, where Apple still holds a modest share. A majority of customers buying iPhones, Macs, iPads, and Apple Watches in India are "all new to that product," and the "strong double-digit growth in the install base" is very encouraging.

Apple Silicon: A Competitive Advantage and Margin Driver

Discussing its internal silicon capabilities, Apple reiterated that Apple Silicon has been an "incredible game changer" since its introduction in iPhone, iPad, and Mac. This proprietary chip development is a "major competitive advantage" providing "opportunities for cost savings and differentiation." It also gives Apple "more control over the roadmap" and positively impacts gross margins.

AI Deployment: On-Device and Private Cloud

Regarding AI management, Apple sees both "on device and private cloud compute" as equally important, not an "either or" scenario. They are confident in their data center capacity to support widespread Siri adoption, having either reserved or currently putting capacity in place, despite not aggressively increasing capex like other "hyperscalers" (large cloud providers).

AI-Capable Devices in the Installed Base

While Apple boasts 2.5 billion active devices, Apple Intelligence features are primarily available on devices from the iPhone 17 Pro onwards. Apple did not provide a specific number for AI-capable devices but confirmed it is "growing as you can imagine and we're encouraged by it."

The call concluded with Apple's stock up just over 1% after hours, trading at $261, reflecting sustained investor confidence in the company's future.

This article, "Apple Reports Record-Setting 1Q 2026 Results: $42.1B Profit on $143.8B Revenue" first appeared on MacRumors.com

Discuss this article in our forums

from MacRumors

-via DynaSage